What is a CIN or Corporate Identification Number?

A CIN is a unique identification number assigned to every company registered under the Companies Act, 2013. Similar to the CIN for Companies , LLP are assigned an LLPIN ( Limited Liability Partnership Identification Number) It’s a combination of letters and numbers that helps identify a corporate entity registered in India. Just like a PAN card is issued by the Income Tax Department, a CIN is allotted by the Ministry of Corporate Affairs

Think of it as your company’s passport, essential for conducting business and interacting with government agencies.

Why is a CIN Essential for Your Business?

CIN is a legal requirement. Rather than offering any benefit, it is a mandatory statutory compliance. All Companies registered in India are allotted a CIN and it is mandatory for them to display the same.

Who Needs a CIN?

Any company incorporated under the Companies Act, 2013 requires a CIN. This includes:

- Private Limited Companies

- Public Limited Companies

- One Person Companies (OPCs)

- Limited Liability Partnerships (LLPs)

Types of Private Limited Companies

On the basis of formation, private limited companies can be classified as below

- Company Limited by Shares: This is the most widely adapted form of Private limited company.Here the share capital is clearly stated in the memorandum of association. The members liability is limited to the value of unpaid amount of the called share capital if any

- Company Limited by Guarantee: Here the members stand guarantee to the liability of the company and their liability to third parties is limited to such amount of guarantee

- Unlimited Companies: Here the members of the companies have unlimited liability towards third party claims , this means in case of losses or liabilities over and above companies resources , the members will have to personally settle the same.

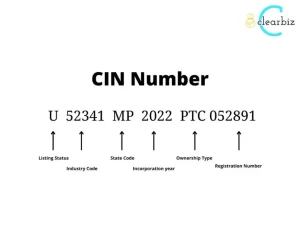

Breaking Down the Corporate Identification Number

Now let us understand what CIN number signifies

A CIN is a 21-character code divided into six sections:

- Section-1: The first character – L: Indicates the company type (L Listed Company U for Unlisted Company)

- Section-2: The next five digits – 01631: Represents the registration year

- Section-3: The next two letters – KA: Indicates the state of incorporation (KA for Karnataka, KL for Kerala Like wise)

- Section-4: The next four digits – 2010: Unique number assigned to the company

- Section-5: The next three characters – PTC: Indicates the company type (PTC for Private Limited Company)

- Section-6: The last six digits – 096843: Unique serial number

Process for Getting the Company Registration Number

Obtaining a CIN is typically a part of the company incorporation process.

Here’s a brief overview of the process of incorporation of a company in India

Step 1: Obtaining Digital Signature Certificates (DSCs)

As per the provisions of the Companies Act and applicable rules, every person acting as a director of a company must hold a valid DSC. Moreover, all Forms are processed online now, and digital signature is a mandatory requirement for signing

Step 2: Applying for Director Identification Number (DIN)

Obtaining a DIN is a prerequisite for joining a company as a director

Step 3: Securing a Unique and Compliant OPC Name

Choose the right identity for your business by ensuring your OPC name is unique and compliant with the prevailing rules. Ensure it does not cause any Trademark objection

Step 4:Keep ready Essential Documents for Registration

Collect necessary documents such as:

- Director’s Identity and Address Proof

- Proof of Registered Office Address

- Prepare Memorandum of Association (MoA) and Articles of Association (AoA)

Step 5: Submitting the completed Incorporation Forms with the Ministry of Corporate Affairs (MCA)

Step 6: Acquiring the Certificate of Incorporation From MCA/ ROC

Penalty for Non-Compliance of Mentioning CIN

Failing to mention the CIN in the required documents can lead to penalties. It is Rs 1000 per day of default, restricted to a maximum of Rs 100,000/-

FAQs

1. How to get a corporate identification number?

CIN is allotted by the MCA at the time of incorporation of the Company . it would be clearly stated in the Certificate of Incorporation

2.How to find a corporate identification number?

The CIN is typically mentioned in the company’s incorporation certificate

3. How long does it take to get a CIN in India?

The process is part of the Incorporation of a Company. Forming a Private Limited Company takes 2-4 weeks, but it can vary depending on various factors.

5. Can I apply for a CIN without incorporating the company?

No, a CIN is assigned only after a company is incorporated.

6. Where do I need to mention the CIN?

The CIN should be mentioned in all official documents, tax returns, and business communications.

7. What documents are required for CIN?

There are no separate set of documents for CIN The required documents are those required for registering a Company

Identity and Address Proof of Directors:

- Aadhar Card/PAN Card

- Passport (for foreign nationals)

- Driving License/Voter ID Card

- Latest Utility Bills (Electricity/Water Bill)

- Latest Bank Statements

- Email Address and Mobile Number

Address Proof of Registered Office:

- Latest Utility Bill of the Registered Office

- Rent Agreement with NOC (No Objection Certificate) from the landlord

8. What happens if I don’t mention the CIN in required documents?

You may face penalties and legal issues for non-compliance.Rs 1000 per day of default restricted to Rs 100,000